Deciphering the Harvard Real Estate Market

Homes in Harvard continue to be in high demand among virtually all demographics, and sale prices during this time of low inventory are certainly reflecting that.

Four homes closed in Harvard during the last 30 days, ranging from $475,000 (33 Craggs Road) to $925,000 (137 West Bare Hill Road). The most eye-popping sale, though, occurred at 5 Oak Hill Road, a cute antique home with an attached office in the center of town, listed at the end of October for $500,000. It closed last week at $575,000, 15% over the original asking price.

More than a dozen more homes are currently under contract, scheduled to close in the upcoming weeks and months. Four are on Bolton Road: the cottage at #26, listed for $475,000; a 13-room 1940s cape at #131, offered at $789,900; #168, a 21-acre former apple farm priced at $1.1 million; and #112, a 22-acre 5-bedroom estate that first came on the market for $2.7 million in July, 2016 but now offered at the dramatically reduced price of $1.75 million. It's due to sell next week.

Based on the fact that 60 homes sold in Harvard during the last 12 months, the 24 that are currently on the market represent more than a four-month supply, but that's a bit misleading. Homes in the $600,000 and under range represented more than 40% of all sales, and continue to be the most highly desired commodities. There are six such homes available today. One, a 1920s colonial at 68 Still River Road, is a foreclosure with a failed septic system, bargain priced at only $274,900, in light of the amount of work that will need to be done.

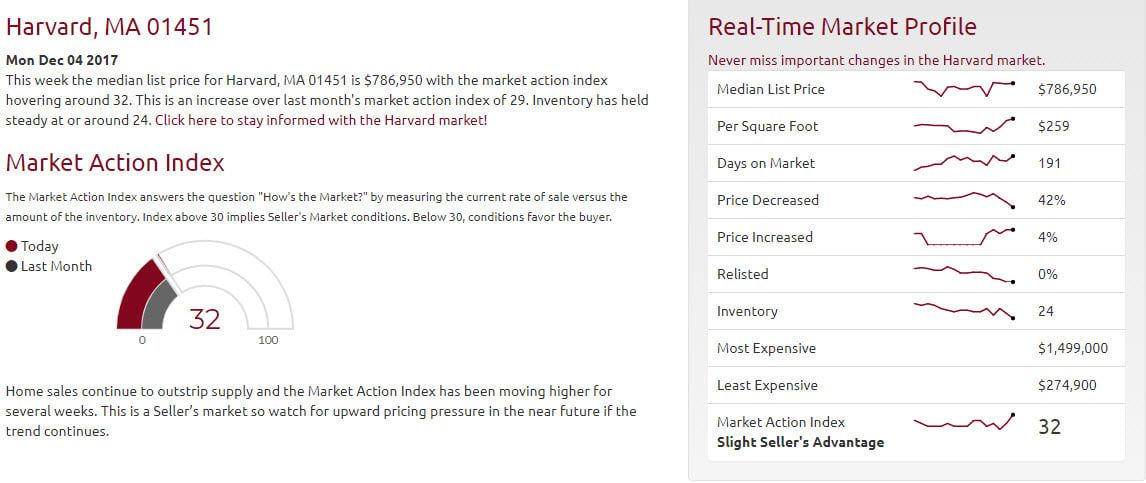

There's no doubt that Harvard is continuing to bask in a sellers' market, as shown in this graph from Altos Research, which advises buyers to "watch for upward pricing pressure in the near future if the trend continues."